美国移动支付市场(2019 - 2026)

With the ever-increasingnumber of smartphone users, it’s become vital for businesses to pay attention to mobile payments.

The latest figures show that the mobile payment market in the US has been growing in recent years and will continue to do so in the years to come. This is especially so for proximity mobile payments and P2P (peer-to-peer) mobile payments, which are among the most mainstream mobile payment methods.

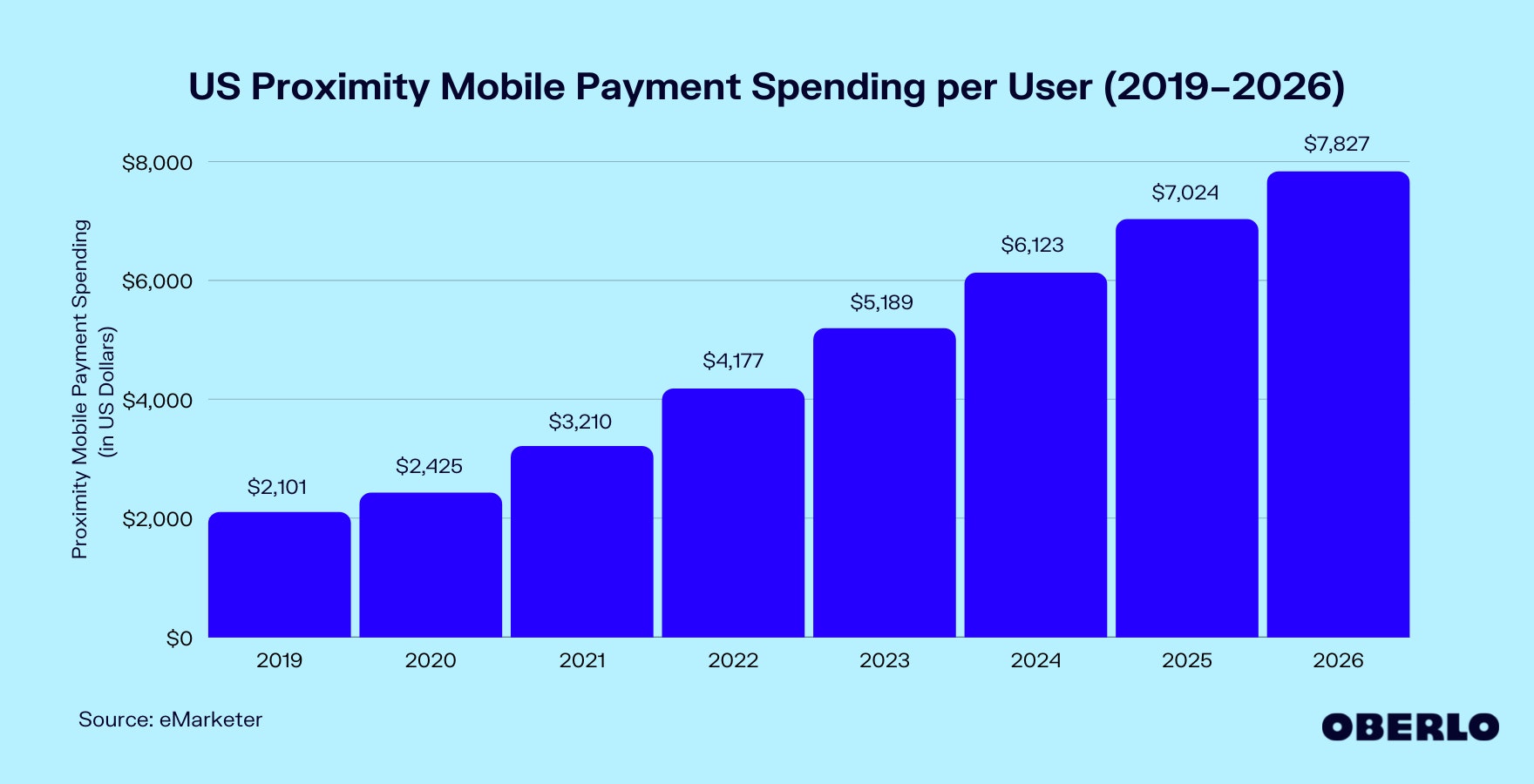

Mobile payment market: proximity mobile payment

According to arecent reporton the mobile payment industry in the US, proximity mobile payment spending per user is expected at $5,189 per mobile phone user in 2023. This is a 24.2% year-over-year increase from $4,177 in 2022.

Proximity mobile payments here refer to point-of-sale transactions carried out through mobile phones (excluding tablets) and can be anything from scanning and tapping to swiping a mobile phone to pay for a purchase.

Such payment methods have become increasingly popular in recent years. Its expenditure per user grew at an annual average rate of 27% from 2019 to 2023.

Though the value of goods purchased using proximity mobile payments per person is set to continue increasing and exceed $7,800 by 2026, its growth is expected to slow. The average annual growth rate from 2024 to 2026 is forecast at 14.7%.

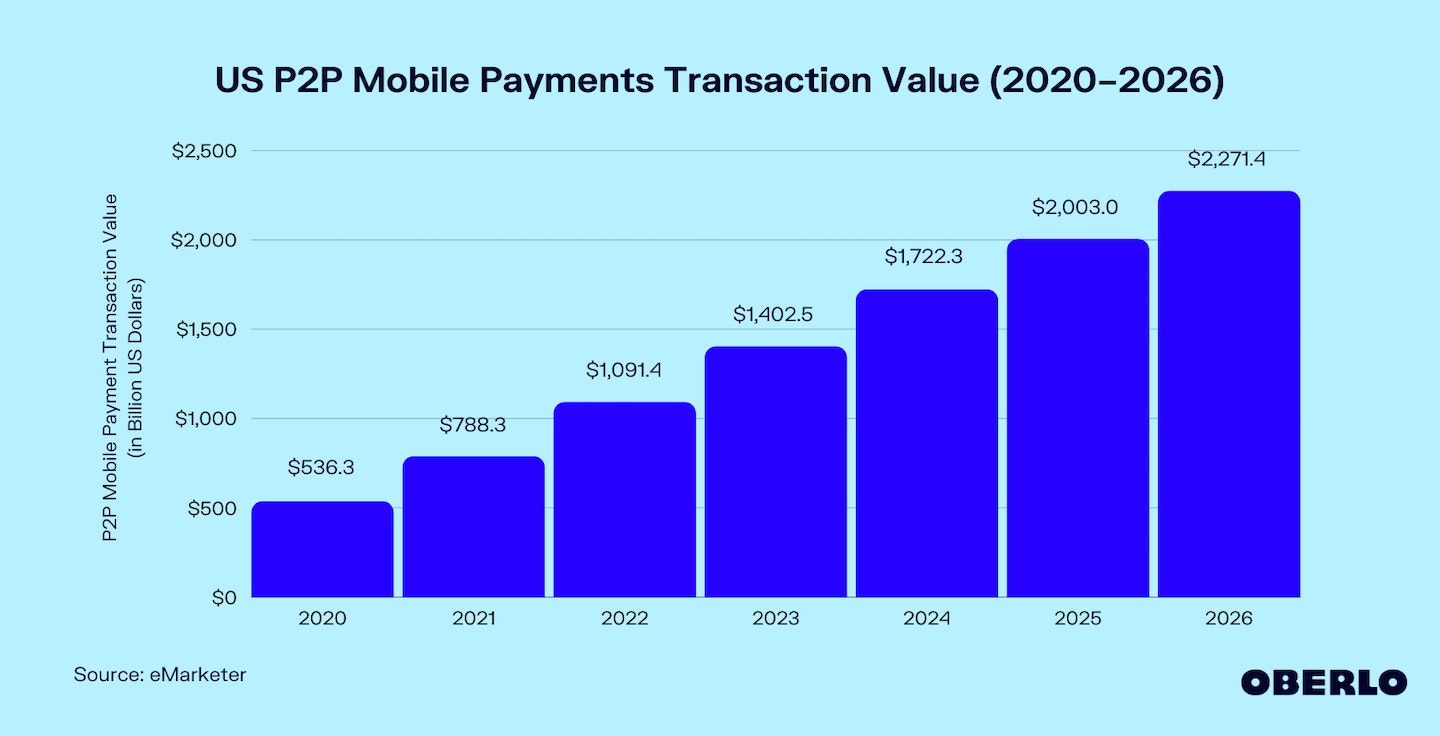

Mobile payment market: P2P mobile payment

P2P mobile payments have also been dominating the US mobile payment market.

The total transaction value from P2P mobile payments is expected at$1.4 trillionin 2023. This marks a 28.5% increase from the $1.1 trillion in 2022, when the total transaction value of P2P mobile payments exceeded $1 trillion for the first time.

The convenience of this payment method means analysts are expecting more consumers to adopt it. As a result, its total transaction value is forecast to increase, albeit at a slower rate. By 2026, the total transaction value of P2P mobile payments in the US is projected to surpass $2.2 trillion.

Mobile payment industry experts have credited the growing popularity of P2P mobile payments to three companies in particular,Venmo,Zelle, and Cash App, which they say are revolutionizing the market.

These three firms have experienced unprecedented growth in recent years as a result of the coronavirus pandemic and have had huge success in getting new users on board their P2P mobile payment service.