Cash flowis a key consideration for any business, but it’s even more important for small businesses. In many cases—especially companies that are just starting out—it’s critical to focus on small business budgeting strategies.

When you pay close attention to things like fixed and variable costs and projected revenue, you’re in a better place to make sound decisions that contribute to your long-term growth.

In this article, we’ll look at key small business budget tips to make sure you have healthy and thriving business finances.

Why your small business needs a budget

Budgeting is crucial for small businesses, even in their early stages. It provides a detailed overview of your company’s financial future, allowing you to make informed decisions to achieve long-term goals.

Additionally, preparing a business budget helps you:

- Identify revenue-boosting opportunities

- Avoid debt during slow months

- Reduce unnecessary expenses

- Maintain financial order for potential loans or investors

- Reinvest surplus funds

- Gain knowledge about spending areas and growth prospects

- Ensure profitability

How to create a small business budget in 7 steps

1. Add up all your income

First things first: you can’t know your budget until you know how much spending money you actually have. Many small business owners make the critical mistake of not tracking this closely enough.

For a business that has one steady income stream, like an ecommerce business, this one is simple to answer. It’s just the revenue you make from your sales. But forother types of businesses, you may need to examine the situation more closely.

For example, if you have more than one location or more than one source of income, you’ll need to take note of those. Different revenue sources can include things like:

- Sales from events like trade shows and other events

- Sales from other locations, like brick-and-mortar stores

- Freelance projects or side projects

- Consulting fees charged separately

As you’re going through, try to look at the past year to get a solid idea of your averages and revenue, especially if you’re a seasonal business that has ebbs and flows. If you’re a brand new business, start with a modest estimate so you end up with more money instead of less.

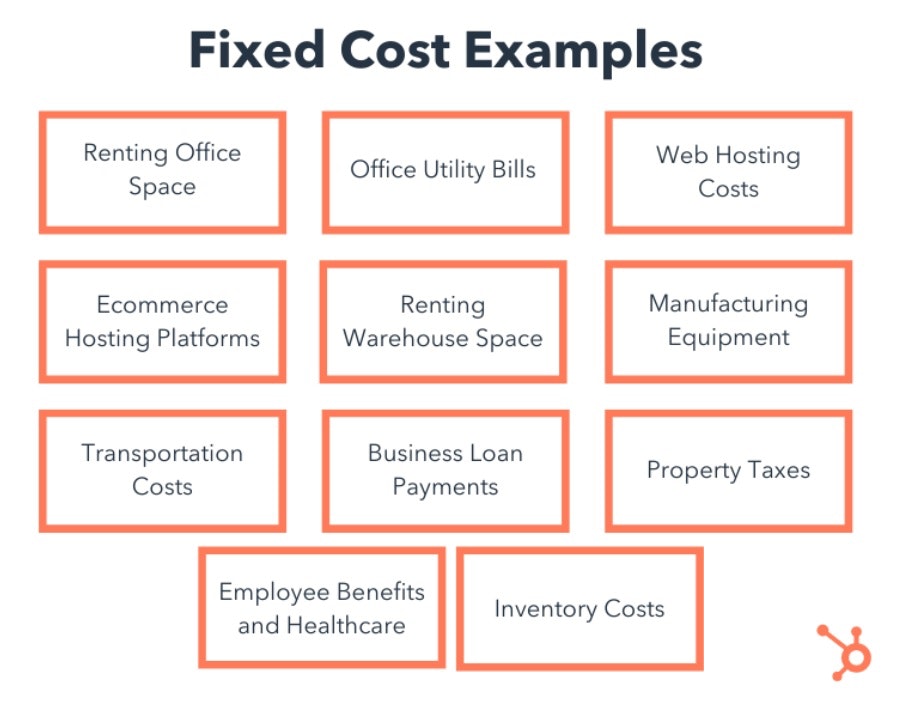

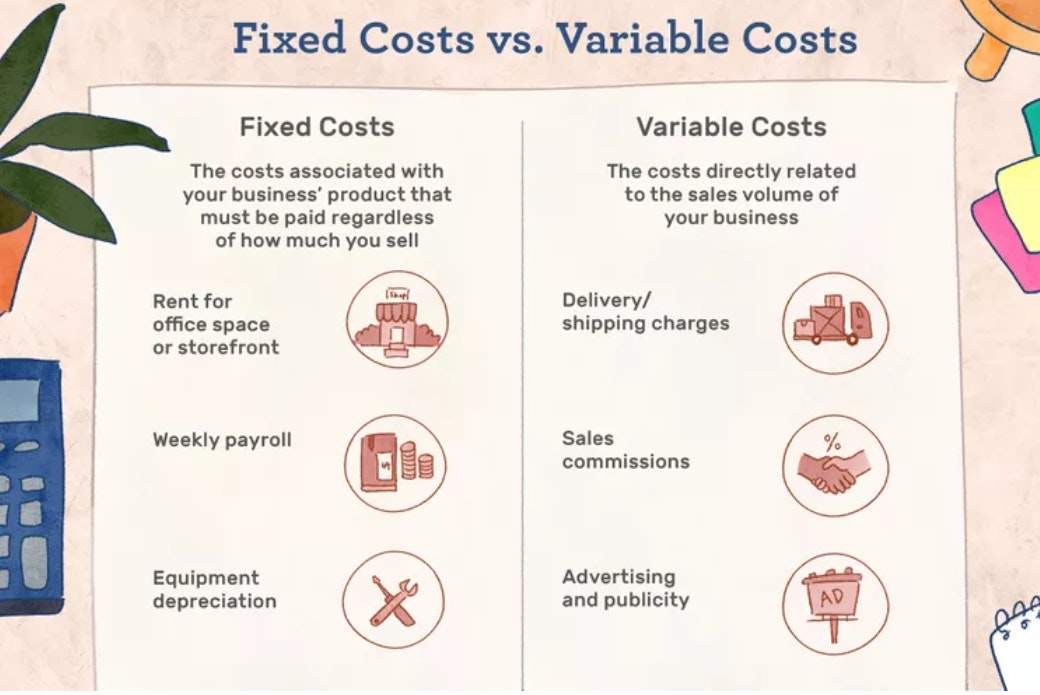

2. Calculate your fixed costs

Fixed costs are the reliable, consistent business expenses that happen on a regular cycle, whether that cycle is per week, per month, per year, and so on. This is where having accounting software can have a big benefit—you’ll be able to go back and see these recurring payments if you don’t already have them noted.

Here are some examples of fixed costs:

- Rent for your office/storefront and equipment

- Supplies that regularly need to be replenished

- Business insurance, loan payments, and taxes

- Payroll and benefits for salaried employees

- Internet and phone service

- Hosting service for your website

- Software subscriptions, memberships, and tools with a monthly fee

3. Don’t forget variable costs

Variable costs are consistent like fixed costs, but the dollar amount varies from month to month. These can be a bit trickier to track than fixed costs, so pay close attention to them.

Here are some examples of variable expenses:

- Raw materials for production, which vary based on your output

- Shipping and delivery costs, which vary based on your sales volume

- Utilities for your office or storefront

- Non-salaried employees, like part-time workers or freelancers and other contractors who don’t have a set monthly pay agreement

- Marketing efforts (which may be fixed if you have a set marketing plan or outsource to an agency)

- Travel costs for events, business meetings, and the like

- Other costs, like professional development and training

Variable costs can play an important role in small business budgeting, especially if you need to save money or spend less. Look at these expenses first for cutting costs.

4. Budget for infrequent spends

These are the ones that can easily slip through the cracks and mess up your business budget. For example, think about purchases that you don’t make often, but still need to make.

This can include hardware purchases like machinery, laptops, and even smaller items like label makers. These are the types of things you don’t buy on a regular basis, but when the need arises, the unexpected costs can put a significant dent in your business budget.

This is especially true when those purchases are critical for you to be able to effectively run your business on a daily basis.

5. Build a contingency fund

Budgeting for unexpected costs is important. What if your equipment breaks down or an accident occurs? Having a budget set aside for such situations can help alleviate stress and maintain financial stability.

While it may not always be possible to have a dedicated emergency fund, alternative options like Shopify Capital's small business funding can help. That said, a reliable contingency fund offers added protection and peace of mind.

6. Create your profit and loss statement

After noting all your income and expenses, do the math and find out your profit margin.

First, consolidate all your business earnings. Then add up all the expenses, including fixed, variable, and one-time expenses. Now subtract your total expenses from your total income to see whether you made any profit.

Here’s a small business budget example:

Expenses:

Fixed costs

- Internet: $65

- Insurance: $100

- Office supplies: $30

- Software subscription: $50

- Utilities: $80

Total fixed costs: $325

Variable expenses

- Freelancer wages: $800

- Travel and entertainment: $150

- Marketing and advertising: $400

- Raw materials: $600

- Shipping and logistics: $200

Total variable expenses: $2,150

One-time expenditures

- Equipment upgrade: $300

- Professional training: $250

- Website development: $500

Total one-time expenses: $1,050

Total expenses: $3,525

总收入(6000美元)的总费用(3525美元)=Total net income ($2,475)

If your business generated a profit, carefully examine your business budget to identify opportunities for strategic investments that can enhance efficiency and facilitate growth.

If you suffered a loss, stay determined. Not all small businesses are consistently profitable. Rather than dwelling on the setback, focus on identifying areas for improvement and prioritise revenue-generating activities tobolster your financial performance.

7. Plan your budget for the upcoming months

Having completed the necessary work, you now possess accurate documentation of your business finances. A good budget, however, goes beyond the present and focuses on the future. While predicting exact future income and expenses is impossible, analysing past data allows for relatively accurate estimates.

Create a forward-looking budget document based on the historical profit and loss statement you developed earlier, encompassing all revenue and expenses. Additionally, consider the timing of hardware or equipment purchases and allocate funds for new acquisitions or professional servicing.

Start the habit and keep it

If you’re new to small business budgeting, it can all feel incredibly overwhelming. But the bottom line is: It’s critical for small businesses to keep an eye on their cash flow and business expenses.

当你意识到的传入和传出的钱,you’ll be in a better position to make smart decisions. You’ll be able to create a forward looking budget—one that funds your growth and accounts for the wild ride of being a small business owner.

Budgeting for small business FAQ

What should a business budget include?

小企业预算应包括任何expected income, such as investments or salaries. It should also include all operating expenses, such as rent, insurance, salaries, and utilities, plus capital expenditures like investments in new technology or equipment. And don’t forget to incorporate other crucial elements into your business budget, including marketing and advertising expenses, taxes, and any associated fees.

What are the different methods of budgeting?

- Incremental budgeting:Incremental budgeting takes the previous year's budget and adjusts it for factors like inflation, material costs, and sales performance. It provides a conservative approach to budget updates.

- Activity-based budgeting:Activity-based budgeting allocates funds based on performed activities, recognizing them as primary cost drivers within an organisation. This method enables targeted resource allocation and aligns budgets with the actual activities contributing to organisational goals.

- Zero-based budgeting:Zero-based budgeting involves starting from scratch each year. All expenses must be justified and allocated to specific departments or projects.

- Rolling budget:A rolling budget is regularly updated and revised to reflect changing market conditions or business growth. It ensures budgets remain relevant and align with the company’s evolving financial needs.

What are the 5 key elements of a budget?

- Income:Money earned from various sources like investments, wages, and government benefits.

- Savings:Costs for transportation, food, health care, housing, and entertainment.

- Expenses: Money saved for future goals like child education or retirement.

- Debt:Outstanding loans and financial obligations.

- Emergency fund:Reserved funds for unforeseen expenses like medical bills or car repairs.

What is the 50/20/30 budget rule?

The 50/20/30 budget rule is a widely recognized budgeting guideline. According to this rule, business owners must allocate 50% of their income to essential expenses such as groceries, utilities and housing, save 20% for financial goals, and use 30% for lifestyle expenses like entertainment.